Trusted car insurance,

just like that.

Get comprehensive car insurance, earn up to 50% of your premiums back in cash, submit a claim, all on our App in a blink. Simply follow our online sign up process. Quick and easy.

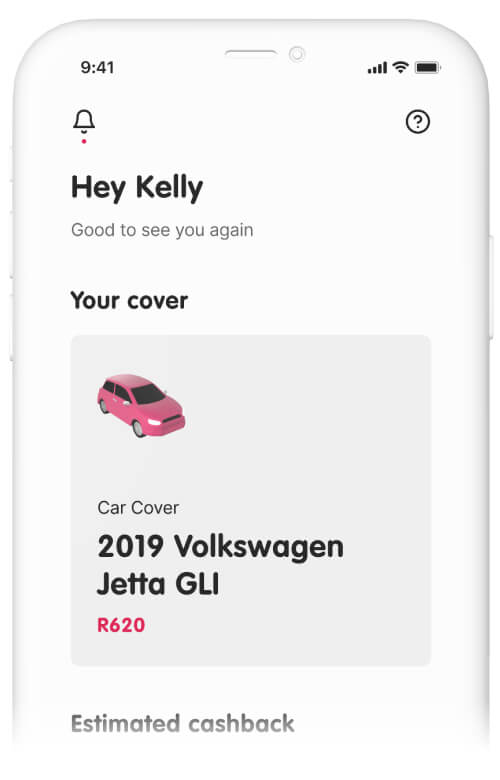

Manage your cover whenever, wherever

The MiWay Blink App is your go-to place for submitting a claim, updating your info, canceling cover, checking policy details, redeeming your cashback and getting help when you need it most, 24/7 cover on the go.

We've got it all covered

You'll get full comprehensive cover for your car at retail value.

Accidents

Theft & hijacking

Weather damage

Damage to others' property

Vandalism

Fire & explosion

Glass damage

Roadside assistance

All about cashback

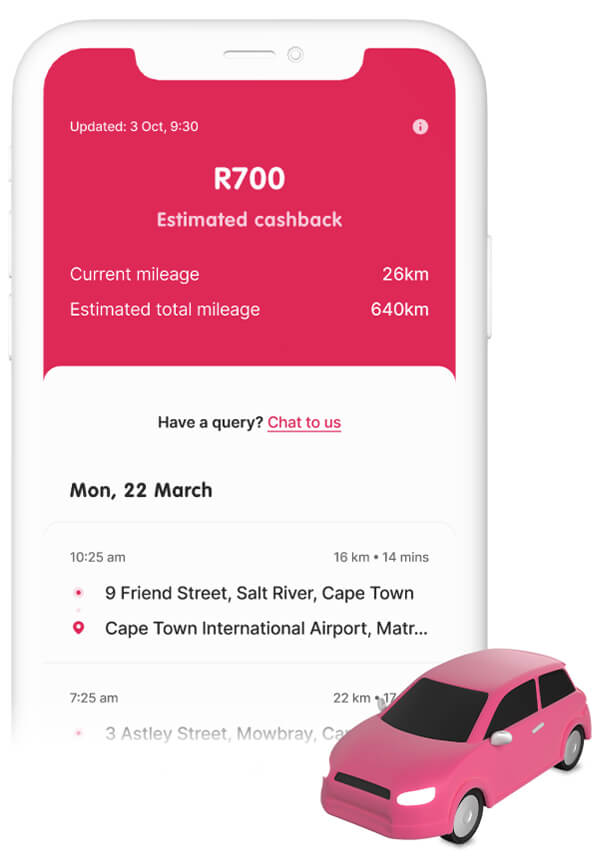

Our base premium is calculated on a monthly driving distance of 2 500km. If you drive less, you qualify for cashback monthly. If you didn't drive at all during the month you'll get 50% of your premium back in cash! After each month of cover, we'll ask you to confirm your car's odometer reading in the App, to avoid any unnecessary confusion.

For instance, you could have been a passenger in a friend's car or in an Uber and if you didn't mark those trips as "not my car" in the App, we could count them towards the distance you've traveled that month, which means, you'd get less cashback paid to you! So, we'd rather check in and make sure we pay you the correct amount.

What about Telematics?

Telematics data is really just your car's location and movement data. This lets us know when you're in an accident. It also allows us to track your trips, so that you can get cashback every month and be sent warnings if we see there is a hail storm coming your way.

"Always allow" - The MiWay Blink App needs permission to access your phone's location services, motion and fitness (iOS) /activity recognition (Android) as well as Bluetooth, so we can accurately track your trips and be made aware of any accidents.

Get covered

in a few quick steps

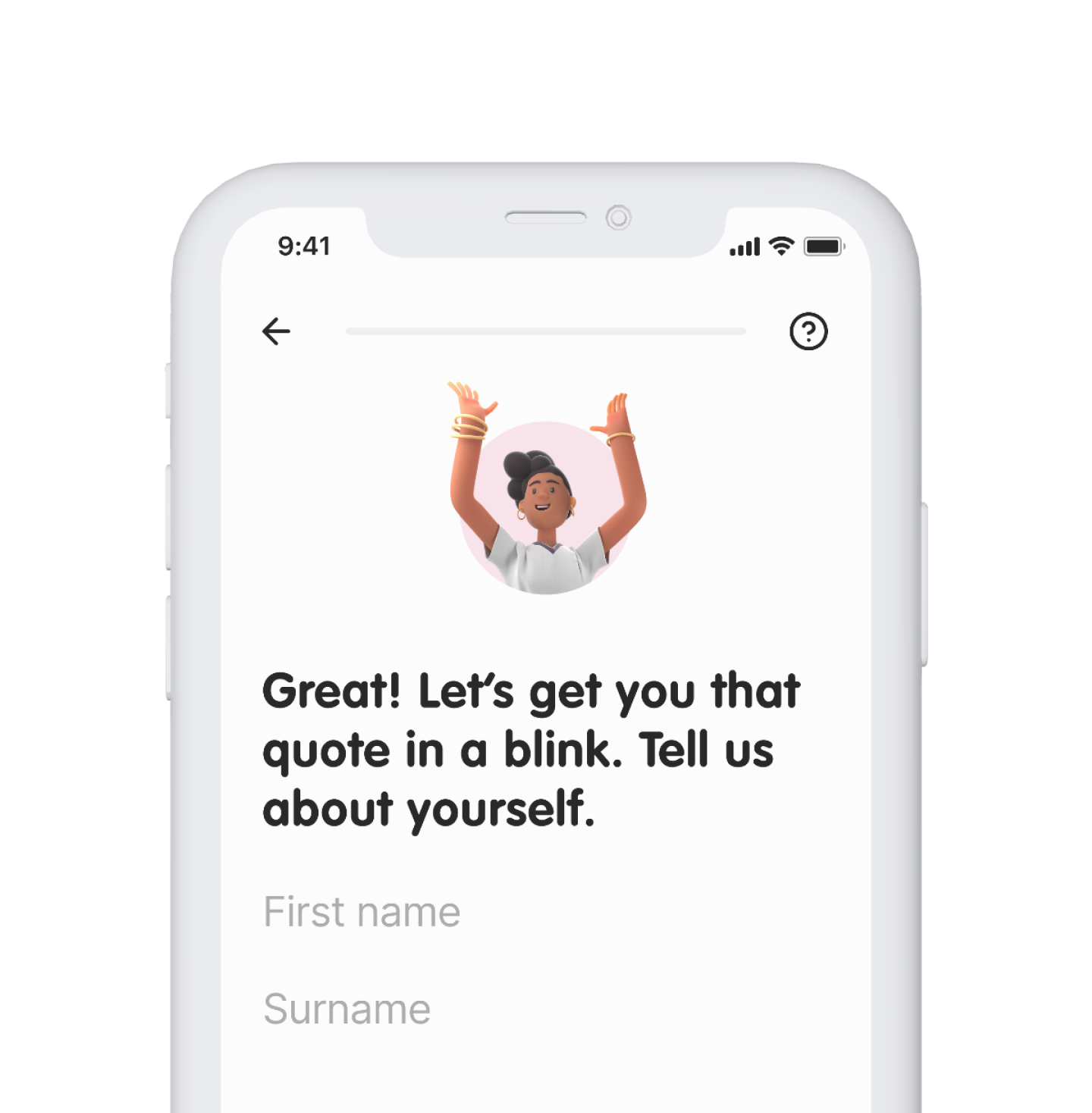

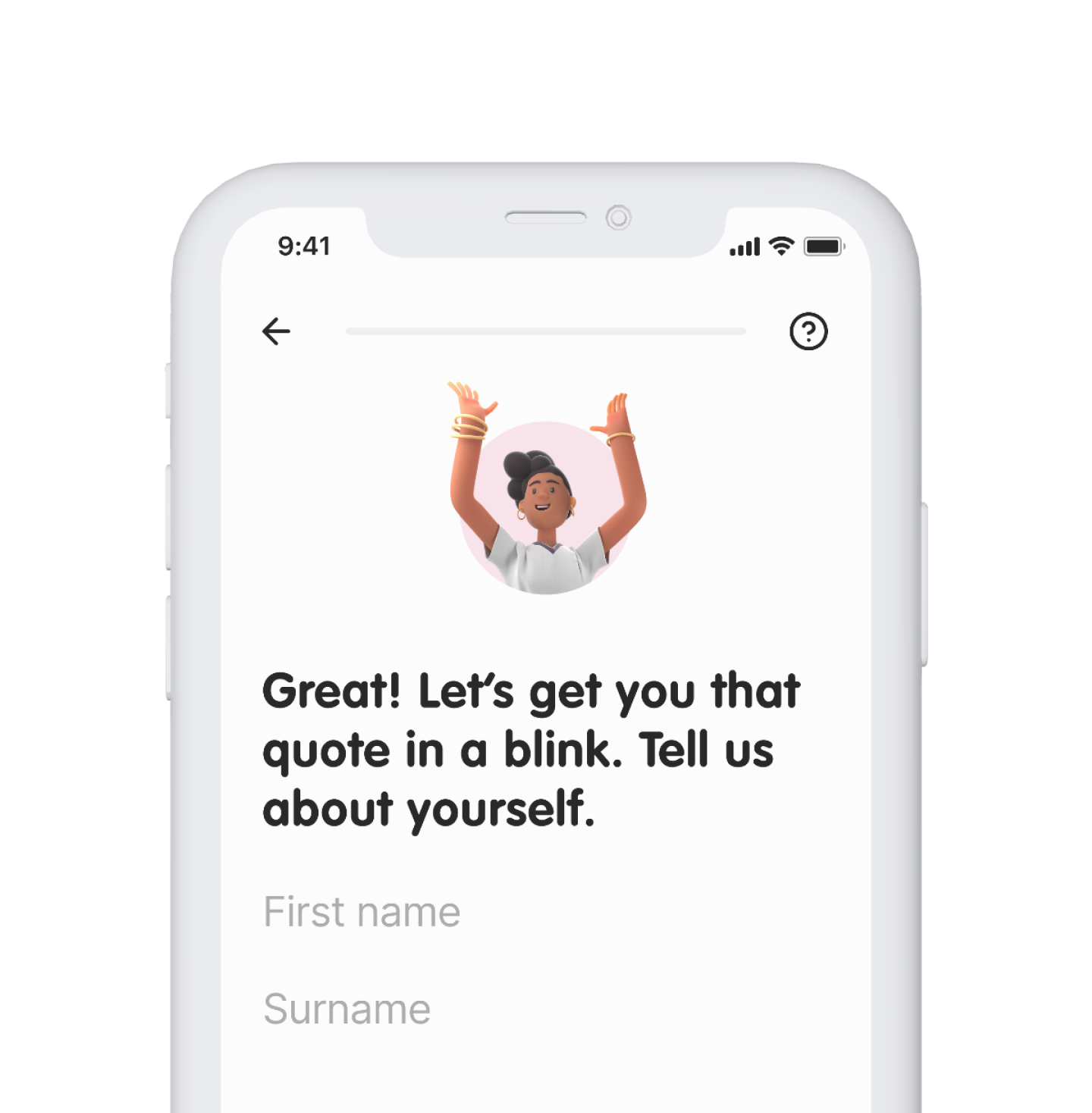

01.

Answer a few questions

You'll need your ID number and car registration number (number plate). We'll crunch the numbers to get you a personalised quote.

02.

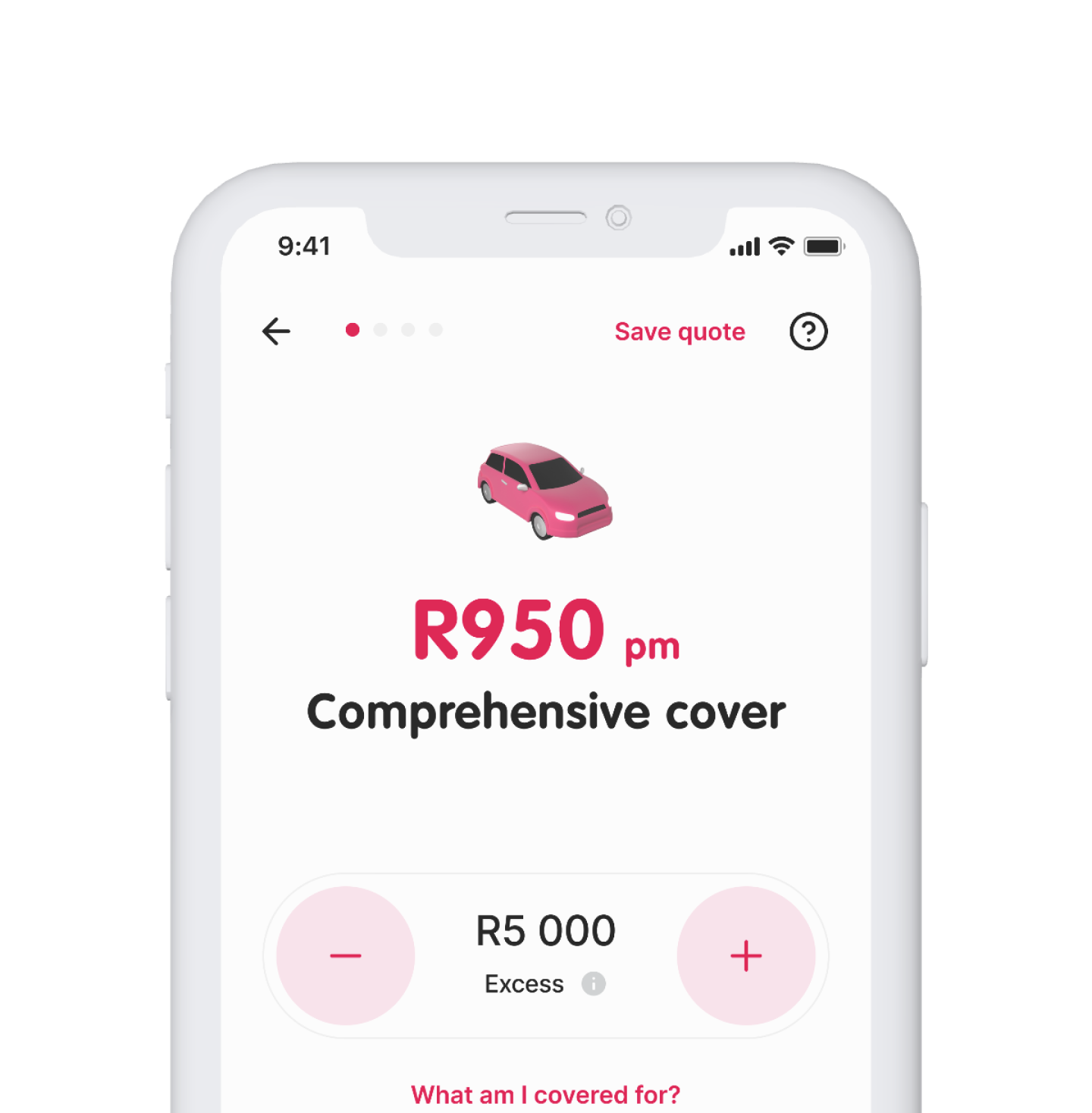

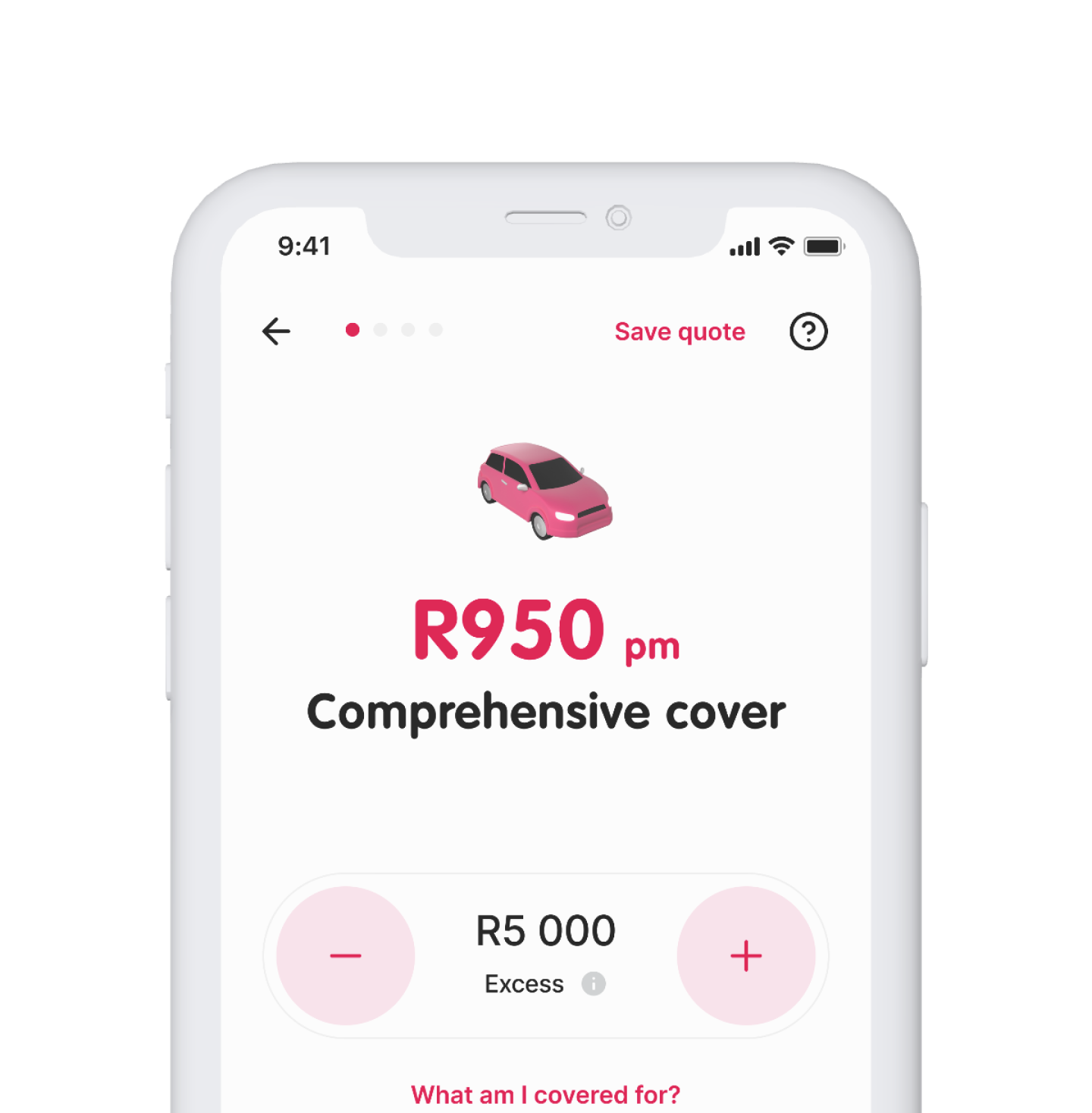

Customise your quote

Choose the excess that works for you, add car hire, credit-shortfall or cover for any extras.

03.

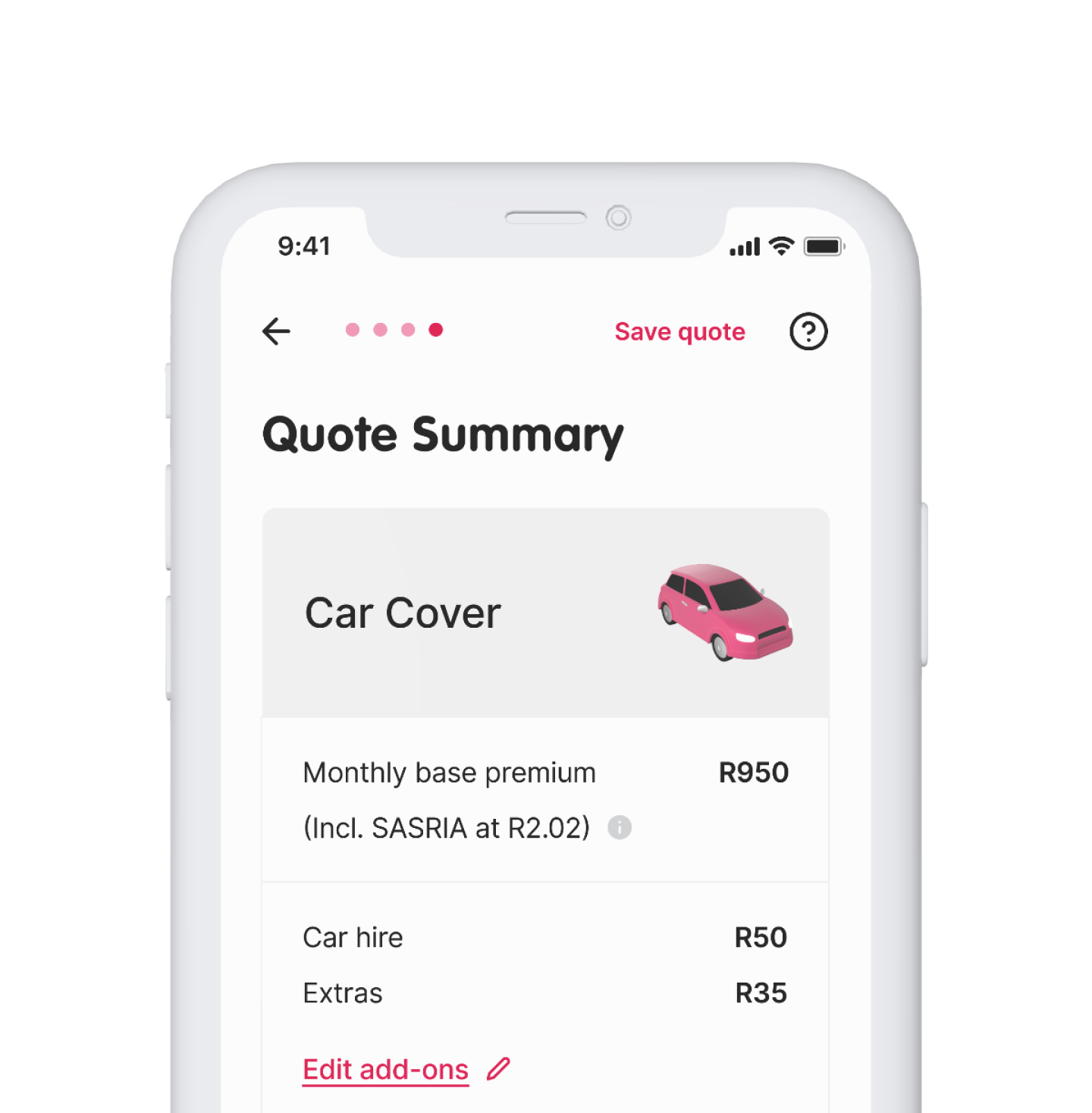

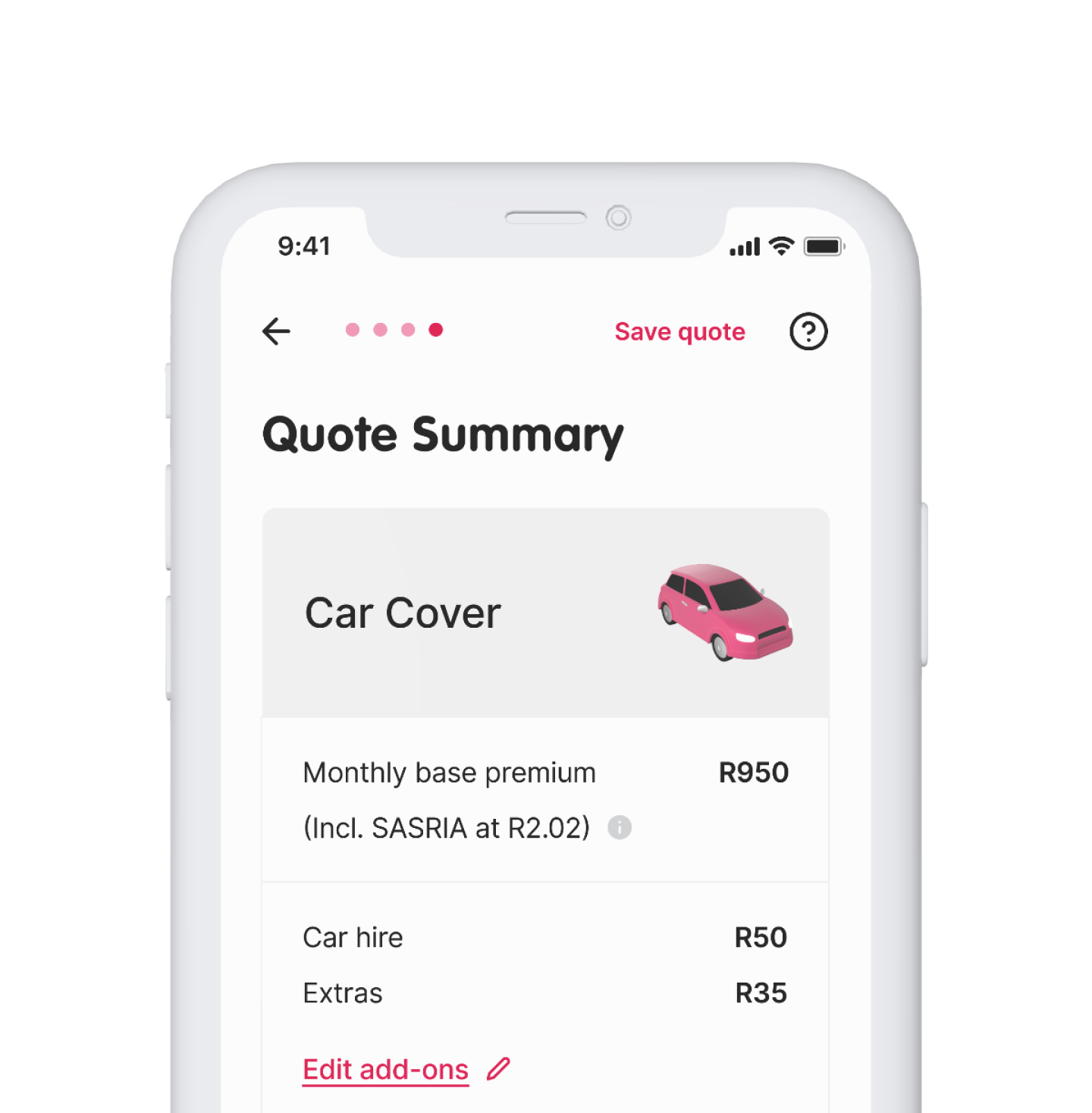

Accept the quote

If you like the premium, accept the quote, enter your bank details and activate your policy.

04.

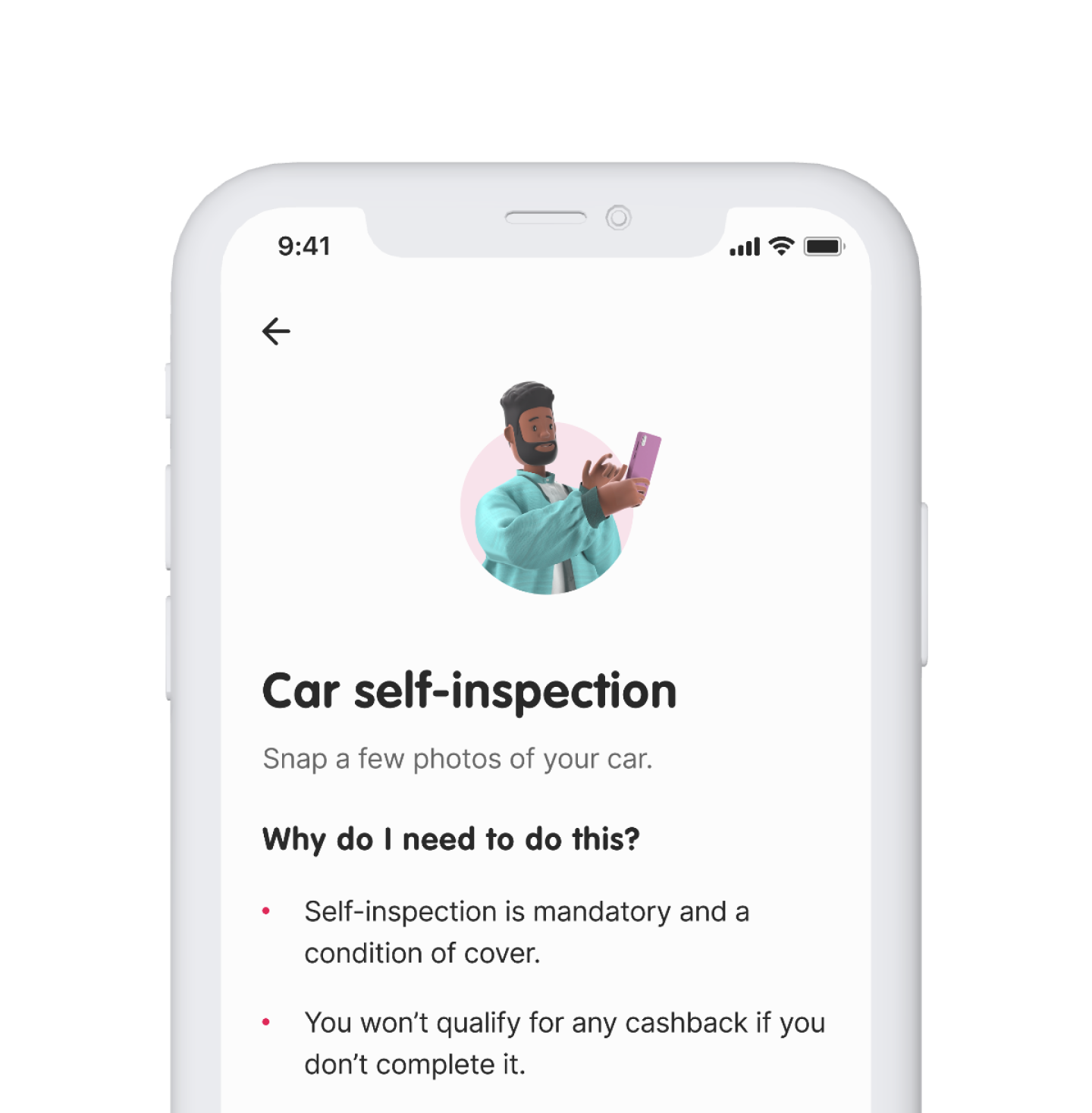

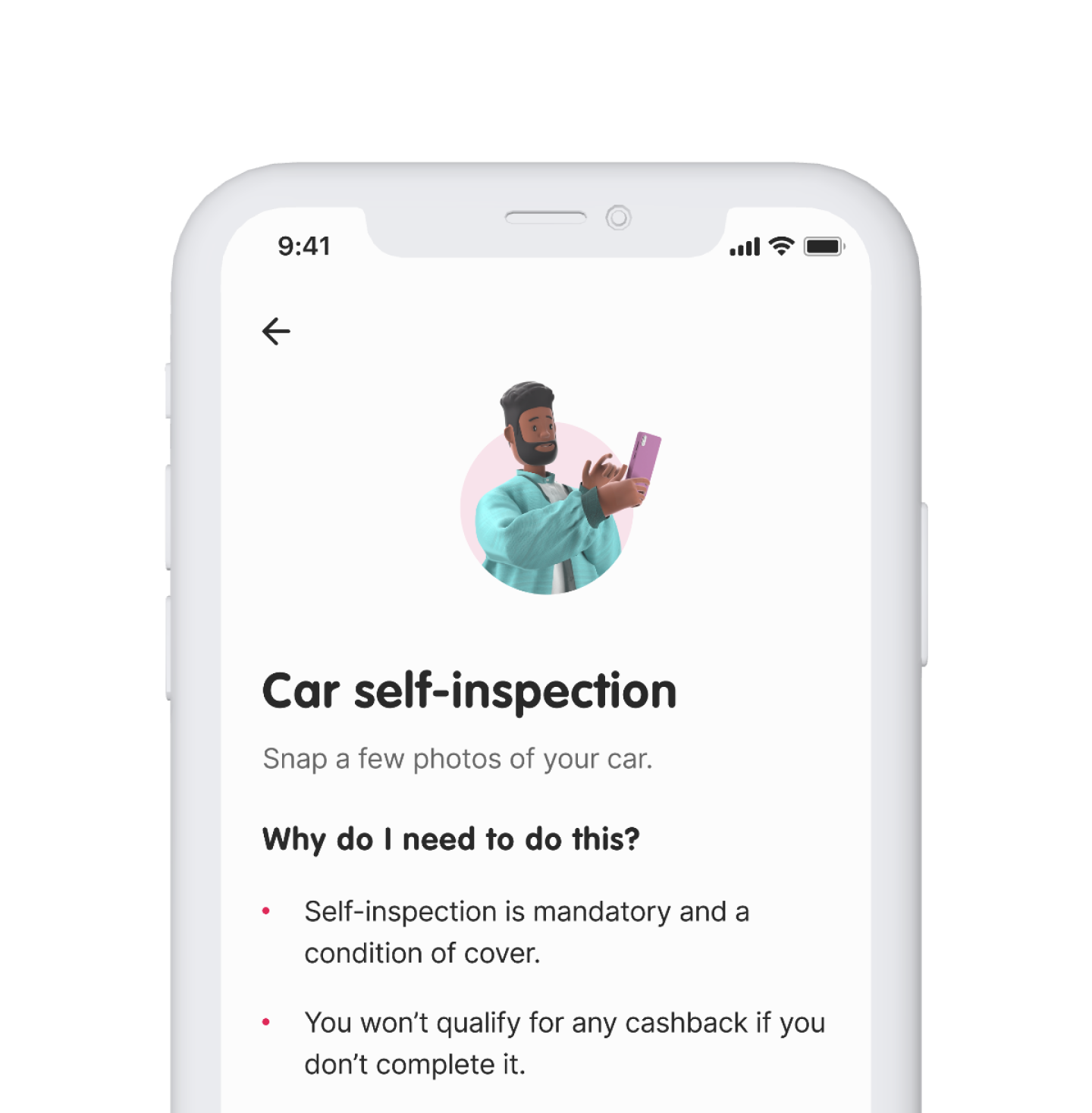

Self-inspection

Download the App if you haven't done so already. We'll walk you through a quick self-inspection of your car. Snap a few pics and you're set.01.

Answer a few questions

You'll need your ID number and car registration number (number plate). We'll crunch the numbers to get you a personalised quote.

02.

Customise your quote

Choose the excess that works for you, add car hire, credit-shortfall or cover for any extras.

03.

Accept the quote

If you like the premium, accept the quote, enter your bank details and activate your policy.

04.

Self-inspection

Download the App if you haven't done so already. We'll walk you through a quick self-inspection of your car. Snap a few pics and you're set.

Insurance made easy.

Ready to sign up?